The term “tax extension” can be misleading, because it causes some folks to believe they can delay paying their taxes. This is not true.

A tax extension simply means that you have the option to file your tax return at a later date (but no later than October 15th of the same year) and without penalty if you are unable to collect all of the information needed to file your taxes by the April 15th deadline. However, even if you file for an extension, you still must pay your taxes due by April 15th.

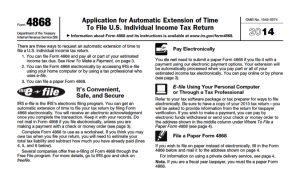

In order to qualify for an extension on filing your taxes, you or your tax preparer must submit Form 4868 to the Internal Revenue Service (IRS), or you must place it in the mail no later than April 15th.

Because this Form is an “Automatic Extension,” you do not need to file anything other than the Form. However, you should send a payment for taxes due along with the Form in order to avoid interest, late fees, and penalties that will accrue until you send in the payment.

To file a Form 4868 for automatic extension of time to file an individual income tax return:

- File electronically, or

- File the form by mail

Do you have a complicated tax situation?

If you feel that your income tax situation is too complicated for the April 15th deadline, then please consider reaching out to the Lawyer Referral & Information Service (LRIS) for a referral to a San Diego-based taxation attorney.